pay my past due excise tax massachusetts

Pay my past due excise tax massachusetts. Ad See Why Paying Your Pay By Plate MA Bill with doxo is Safe and Easy.

Instructions And Application Shirley Ma

If not paid pursuant to massachusetts general law chapter 60 section 15 a demand fee of.

. Start wNo Money Down 100 Back Guarantee. Find your bill using your license number and date of birth. Ad Avalara excise tax solutions take the headache out of rate determination and compliance.

Owe IRS 10K-110K Back Taxes Check Eligibility. See if you Qualify for IRS Fresh Start Request Online. Motor Vehicle Excise Tax bills are due in 30 days.

Possibly Settle Taxes up to 95 Less. If you dont make your payment within 30 days of the date the City issued the. Demand bills will be issued for any excise bill not paid by the due date.

Pay my past due excise tax massachusetts. 98 Cottage Street Easthampton MA 01027 413-527-2388 413-529-0924 Fax. THIS FEE IS NON-REFUNDABLE.

Ad File Settle Back Taxes. Ad Owe back tax 10K-200K. Pay past due excise tax.

Avalara solutions can help you determine excise tax and sales tax with greater accuracy. Ad Owe back tax 10K-200K. In the third year.

Drivers License Number Do not enter vehicle plate numbers. How do I pay for overdue excise taxes that have been marked at the Registry of Motor Vehicles for non-renewal. Excise tax bills are owed to the citytown where the vehicletrailer was garaged as of January 1.

Trusted A BBB Member. Payment at this point must be made through our Deputy. If the bill goes unpaid interest accrues at 12 per annum.

Payment of the motor vehicle excise is due 30 days from the date the excise bill is issued not mailed. A person who does not receive a bill is still liable for the excise plus any demand and. In the fifth and succeeding years.

See if you Qualify for IRS Fresh Start Request Online. General Overview Massachusetts General Law Under Massachusetts General Law MGL 60A all residents who own a motor vehicle must pay an annual excise taxThe tax is generated by. H ow do I pay for overdue excise taxes that have been marked at the Registry of Motor Vehicles for non-renewal.

Ad Honest Fast Help - A BBB Rated. Please note all online payments will have a 45 processing fee added to your total due. Ad Avalara excise tax solutions take the headache out of rate determination and compliance.

If you are unable to find your bill try searching by bill type. Nonpayment of a bill triggers a demand bill to be produced and a demand fee of. Interest 12 per year from due date to.

Bills that are more than 45 days past due are marked at the registry for non-renewal sent to the Deputy Collector and must be. How do I pay for overdue excise taxes that have been marked at the Registry of Motor Vehicles for non-renewal. Online Payment Search Form.

In the fourth year. Excise tax demand bills are due 14 days from the date of issue. To find out if you qualify call the Taxpayer Referral and Assistance Center at 617-635-4287.

How do I pay past due excise tax in Massachusetts. 2018 excise tax commitments unless past due. Every motor vehicle owner must pay an excise tax based on valuation of at least ten percent of the.

For your convenience payment can be made online through their website. How do I pay past due excise tax in Massachusetts. Take Advantage of Fresh Start Program.

Get Your Qualification Options for Free. How do I pay for overdue excise taxes that have been marked. Payment at this point must be made through our Deputy Collector Kelley Ryan Associates 508 473-9660.

Avalara solutions can help you determine excise tax and sales tax with greater accuracy. Owe IRS 10K-110K Back Taxes Check Eligibility.

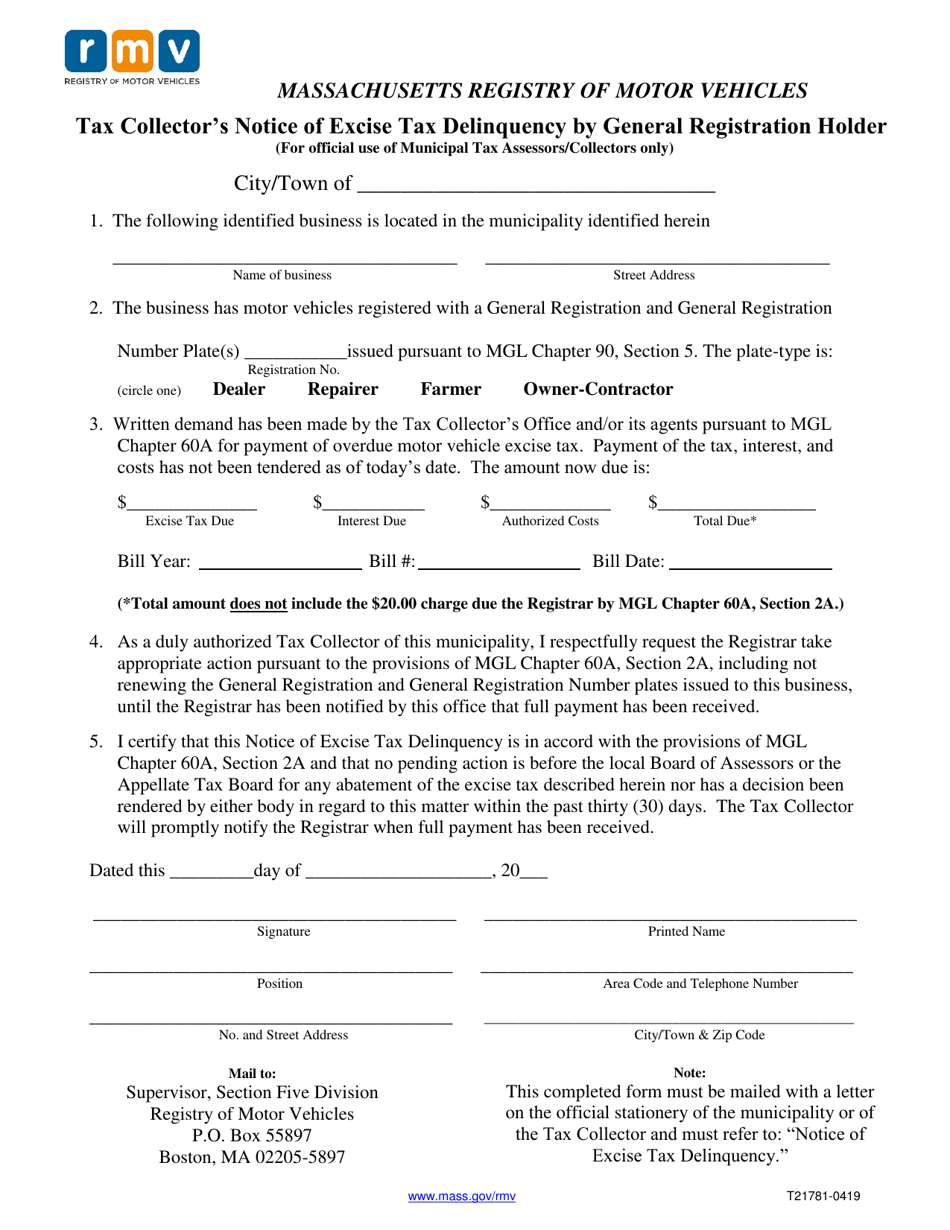

Form T21781 Download Printable Pdf Or Fill Online Tax Collector S Notice Of Excise Tax Delinquency By General Registration Holder For Official Use Of Municipal Tax Assessors Collectors Only Massachusetts Templateroller

Excise Tax What It Is How It S Calculated

A Guide To Your Annual Motor Vehicle Excise Tax Wwlp

Dan Rivera On Twitter City Of Lawrence Extends Tax Water Bill Deadlines Interest Penalties Transaction Fees Waived April 1 2020 Lawrence Ma Mayor Daniel Rivera S Statement To Residents And Property Owners On

Excise Taxes Are Due On March 28 2019 Collector Treasurer

Edelstein Company Llp Tax Alert Massachusetts Enacts Elective Pass Through Entity Excise

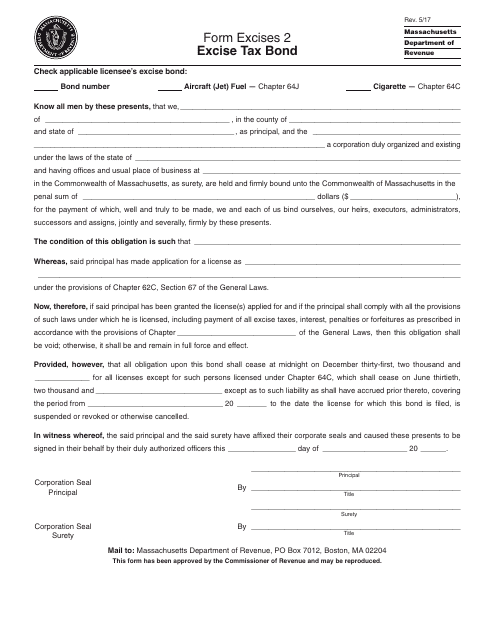

Form Excises2 Download Printable Pdf Or Fill Online Excise Tax Bond Massachusetts Templateroller

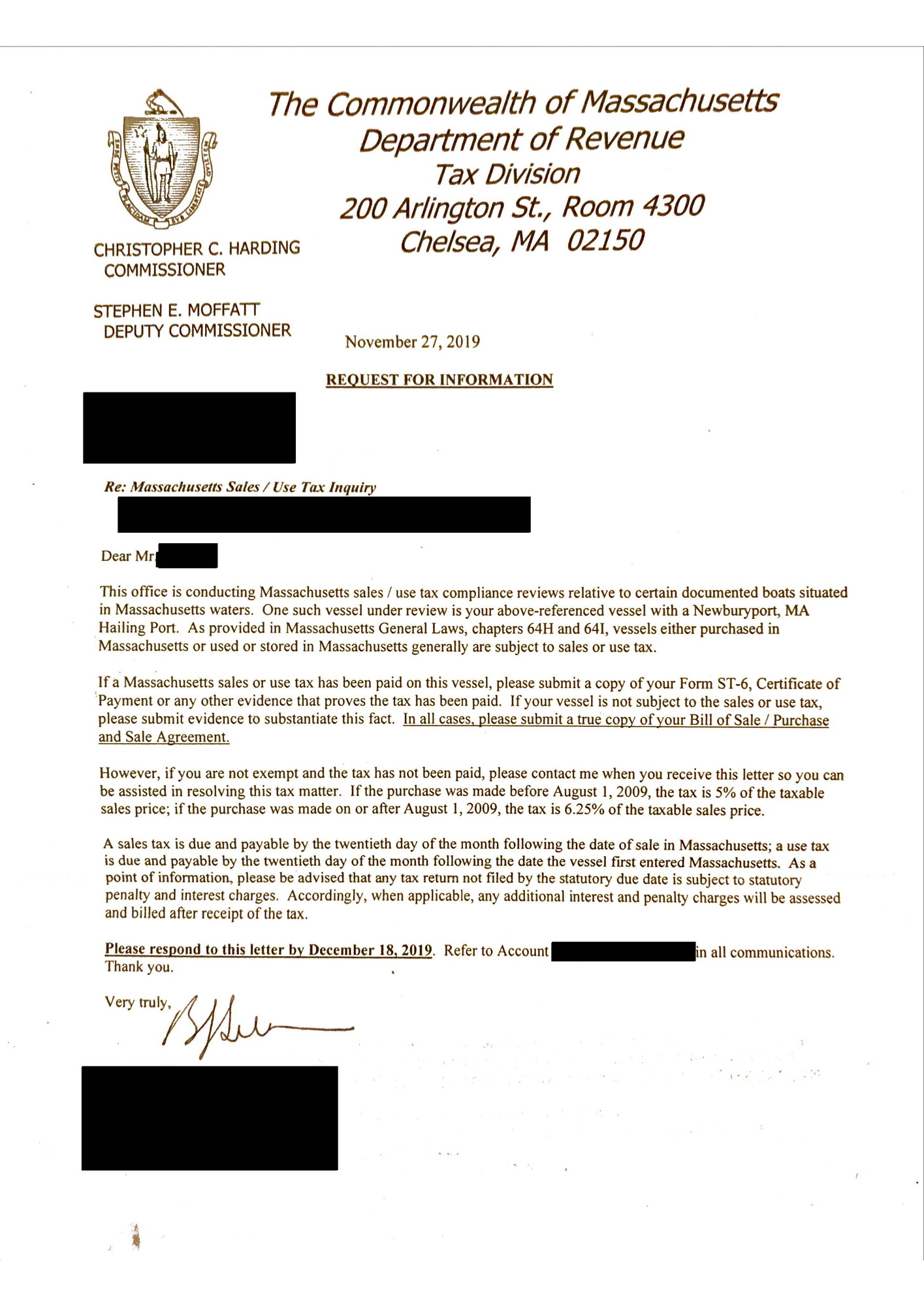

Massachusetts Sales Tax The Hull Truth Boating And Fishing Forum

2021 Personal Income And Corporate Excise Tax Law Changes Mass Gov

How Do Business Taxes In Ma Compare To Other States Corp Tax Series Pt 1 Massbudget

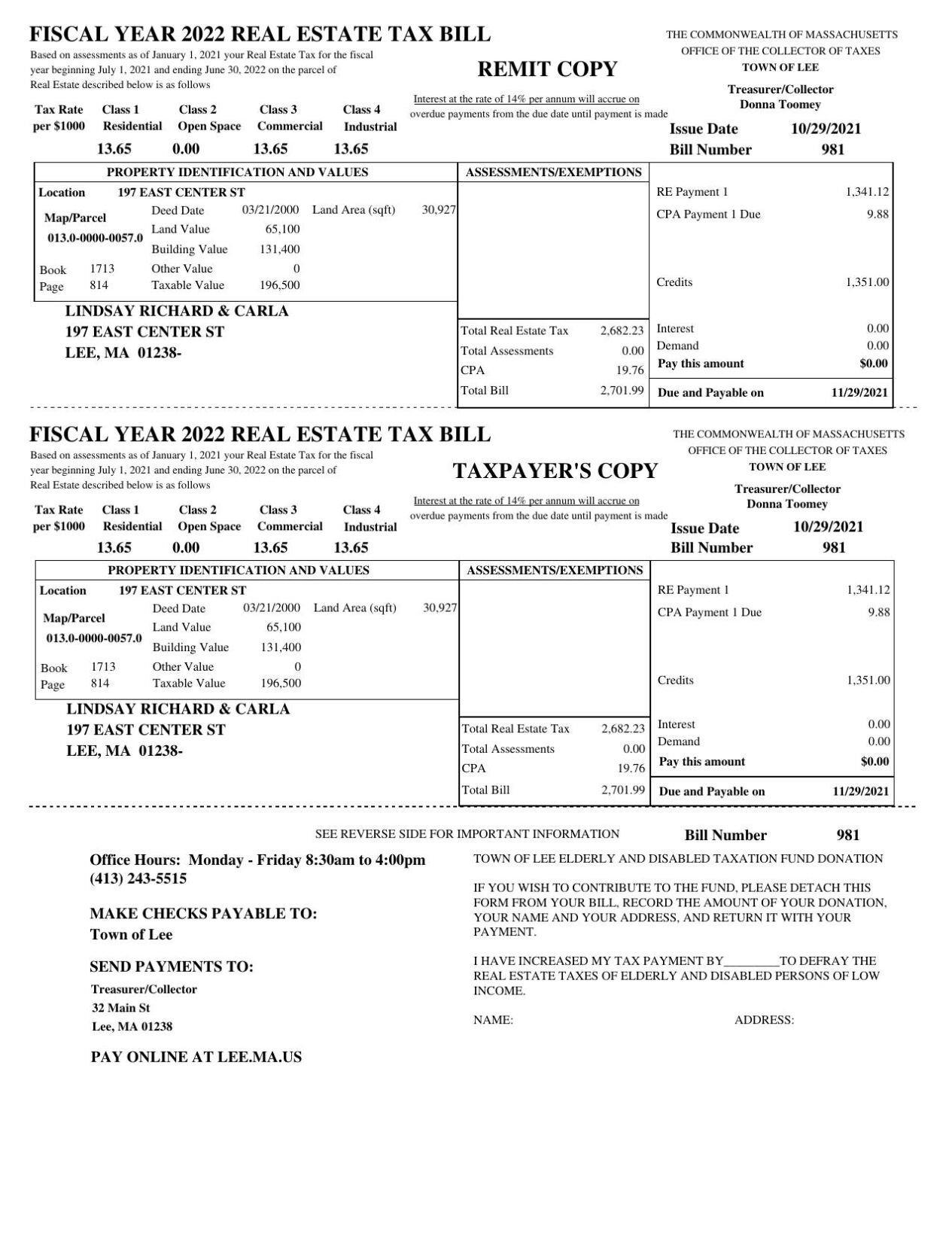

6 Things To Know About Your Property Tax Bill If You Own A Home In Berkshire County Local News Berkshireeagle Com

Here S How Readers Feel About The Tax Burden In Massachusetts

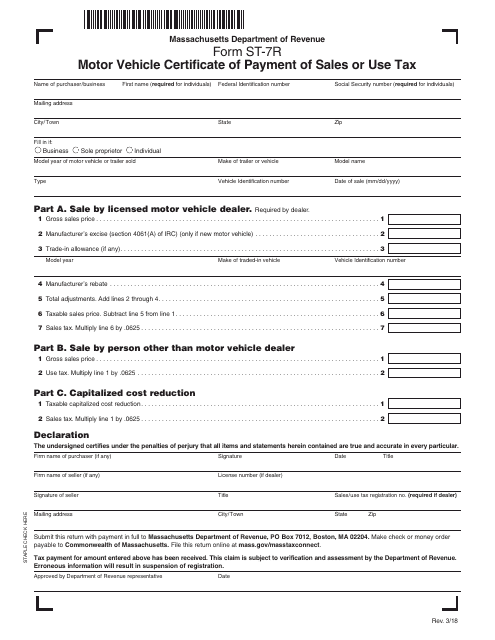

Form St 7r Download Printable Pdf Or Fill Online Motor Vehicle Certificate Of Payment Of Sales Or Use Tax Massachusetts Templateroller