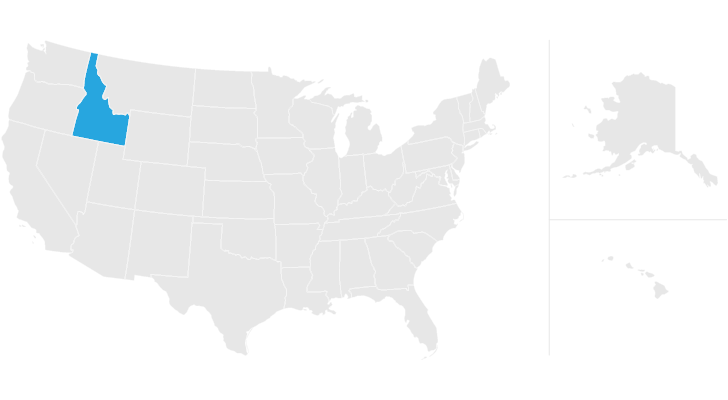

does idaho have capital gains tax

208 334-7660 or 800 972-7660 Fax. Idaho axes capital gains as income.

Historical Idaho Tax Policy Information Ballotpedia

Like the Federal Income Tax Idahos income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers.

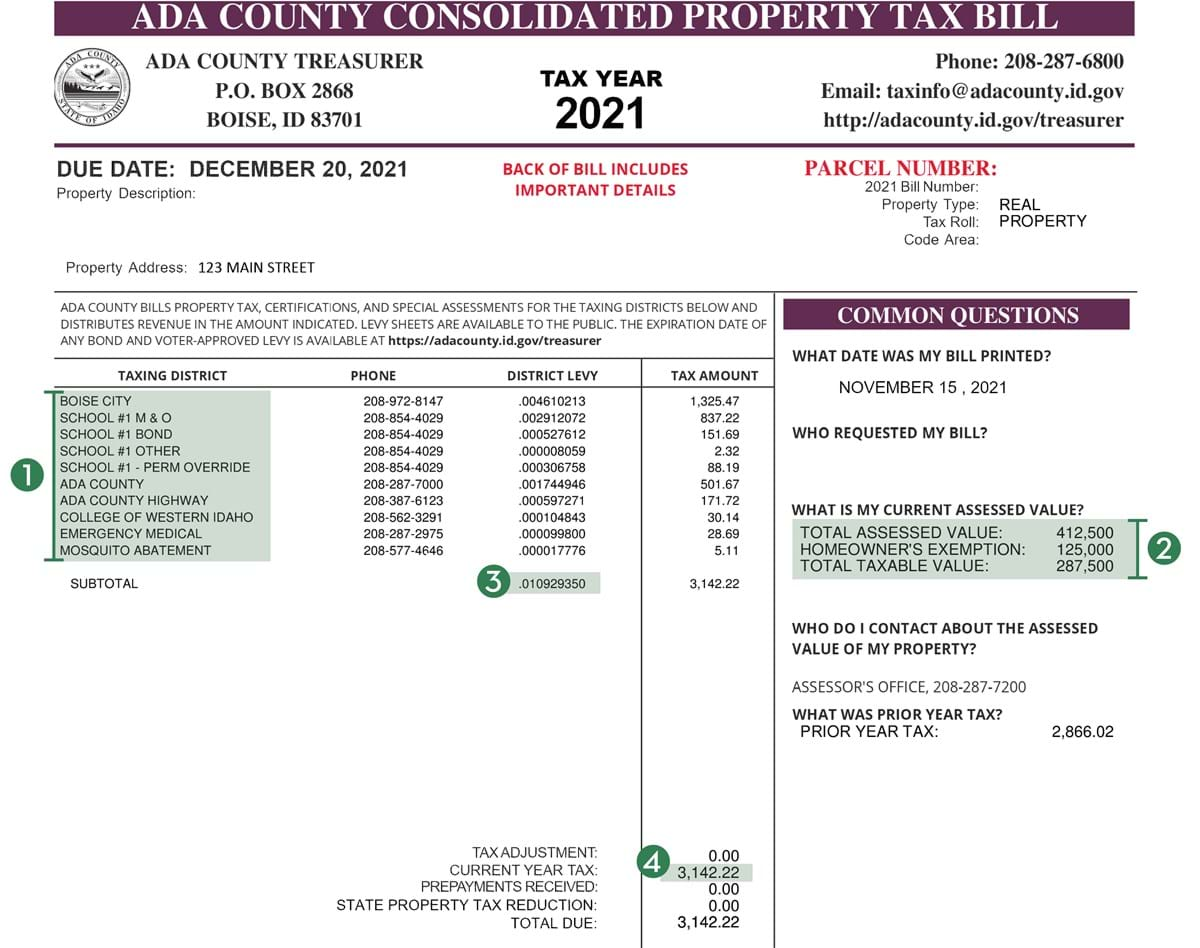

. Section 63-3039 Idaho Code Rules and Regulations Publication of Statistics and Law Who do I contact for more. Does Idaho have an Inheritance Tax or an Estate Tax. Idaho has a 600 percent state sales tax rate a 300 percent max local sales tax rate and an average combined state and local sales tax rate of 602 percent.

Does Idaho have an Inheritance Tax or an Estate Tax. Idaho doesnt have an estate or inheritance tax for. The rate reaches 693.

208 334-7846 taxrep. Use Form CG to compute an individuals Idaho capital gains deduction. States have an additional capital gains tax rate between 29 and 133.

Precious metals in bullion form are a constitutional form of money and should be treated as such when it comes to taxation. 208 334-7660 or 800 972-7660 Fax. The Idaho Income Tax.

Section 63-105 Idaho Code Powers and Duties - General Income Tax. Short-term capital gains come from assets held for under a year. Keep in mind that if you inherit property from another state that state may have an estate tax that applies.

Wages salaries 100000 Capital gains - losses -50000. Whats the capital gains tax in Idaho. The rate reaches 693.

However the state does not charge this capital gains tax on the sale of traditional currency no matter how much it might have inflated. Taxes capital gains as income and the rate is a flat rate of 495. Capital gains are taxed as ordinary income in Idaho.

Each states tax code is a multifaceted system with many moving parts and Idaho is no exception. State Tax Commission PO. What is the sales tax in Coeur D Alene Idaho.

Capital Gains Tax Calculator 2022. 500000 for married couple - will not be taxable. Idaho collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

Because this is a farm it is impossible forme to figure the actual exact tax rate for this sale. Idaho does not levy an inheritance tax or an estate tax. Your income and filing status make your capital gains tax rate on real estate 15.

Box 36 Boise ID 83722-0410 Phone. Idahos tax system ranks 17th overall on our 2022 State Business Tax Climate Index. The capital gains rate for Idaho is.

Capital gains for farms is. Idaho axes capital gains as income. A majority of US.

The capital gains rate for Idaho is. The rates listed below are for 2022 which are taxes youll file in 2023. Idaho does have a deduction of up to 60 of the capital gain net income of qualifying Idaho property.

Should I Refinance My Mortgage. Capital Gains Taxes. HB 449 would eliminate the state capital gains tax on the sale of precious metals.

Section 63-3039 Idaho Code Rules and Regulations Publication of Statistics and Law Who do I contact for more information on this rule. Taxes capital gains as income and the rate is a flat rate of 495. State Tax Commission PO.

Calculate Your Capital Gains Tax. Idaho does not levy an inheritance tax or an estate tax. Inheritance and Estate Tax and Inheritance and Estate Tax Exemption.

This is the rate you will be charged in almost the entire state with a few exceptions. The minimum combined 2022 sales tax rate for Coeur D Alene Idaho is 775. The percentage is between 16 and 78 depending on the actual capital gain.

Based on filing status and taxable income long-term capital gains for tax year 2021 will be taxed at 0 15 and 20. Intangible property like stocks or bonds does not qualify for the capital gains deduction under any circumstances. Subscribe to our Newsletter.

There are 19 that also charge a local sales tax in addition to the state sales tax. The District of Columbia moved in the. Idahos maximum marginal income tax rate is the 1st.

Idahos state sales tax is 6. What is the sales tax rate in Coeur D Alene Idaho.

Idaho Income Tax Calculator Smartasset

Taxes 1099 R Public Employee Retirement System Of Idaho

The Ultimate Guide To Idaho Real Estate Taxes

Idaho Tax Forms And Instructions For 2021 Form 40

Idaho Income Tax Calculator Smartasset

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic

Idaho State 2022 Taxes Forbes Advisor

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Capital Gains Tax Idaho Can You Avoid It Selling A Home

2022 Tax Filing Season Begins January 24 Idaho Bigcountrynewsconnection Com

Idaho Doesn T Review Its Tax Exemptions Billions Go Uncollected Annually Report Says Idaho Capital Sun

Idaho Tax Rates Rankings Idaho State Taxes Tax Foundation

Capital Gains Tax Idaho Can You Avoid It Selling A Home

Idaho Opportunity Zones Oz Funds Investing Id Tax Benefits

Idaho 529 Plan And College Savings Options Ideal College Savings Plan